4 Simple Techniques For Custom Private Equity Asset Managers

Wiki Article

8 Easy Facts About Custom Private Equity Asset Managers Shown

(PE): investing in business that are not publicly traded. Roughly $11 (https://hub.docker.com/u/cpequityamtx). There might be a couple of things you do not understand concerning the market.

Partners at PE companies elevate funds and manage the cash to yield beneficial returns for investors, usually with an investment perspective of between 4 and 7 years. Personal equity companies have a variety of financial investment choices. Some are rigorous sponsors or passive investors wholly depending on management to grow the business and produce returns.

Since the very best gravitate towards the larger deals, the middle market is a substantially underserved market. There are extra vendors than there are highly seasoned and well-positioned financing professionals with considerable purchaser networks and sources to manage an offer. The returns of personal equity are commonly seen after a few years.

Get This Report on Custom Private Equity Asset Managers

Flying below the radar of huge international companies, most of these small firms often supply higher-quality customer care and/or niche product click reference or services that are not being offered by the big corporations (http://dugoutmugs01.unblog.fr/?p=3148). Such advantages attract the rate of interest of exclusive equity companies, as they possess the insights and savvy to manipulate such possibilities and take the business to the next degree

A lot of supervisors at profile business are offered equity and bonus offer compensation structures that reward them for striking their financial targets. Personal equity opportunities are commonly out of reach for people who can not spend millions of bucks, yet they shouldn't be.

There are policies, such as limits on the accumulation amount of cash and on the number of non-accredited investors (Private Equity Firm in Texas).

4 Simple Techniques For Custom Private Equity Asset Managers

One more disadvantage is the absence of liquidity; when in an exclusive equity transaction, it is challenging to leave or sell. There is a lack of versatility. Personal equity likewise includes high charges. With funds under management currently in the trillions, private equity companies have actually ended up being appealing financial investment automobiles for rich people and organizations.

Currently that access to private equity is opening up to more private investors, the untapped potential is becoming a truth. We'll begin with the main arguments for spending in personal equity: Just how and why private equity returns have actually traditionally been higher than various other properties on a number of levels, Exactly how including private equity in a portfolio affects the risk-return profile, by aiding to expand versus market and intermittent danger, After that, we will certainly outline some vital factors to consider and dangers for personal equity investors.

When it comes to presenting a new property right into a portfolio, one of the most fundamental factor to consider is the risk-return profile of that property. Historically, personal equity has actually exhibited returns similar to that of Arising Market Equities and greater than all other standard possession classes. Its reasonably reduced volatility combined with its high returns makes for a compelling risk-return account.

Custom Private Equity Asset Managers Can Be Fun For Everyone

Exclusive equity fund quartiles have the widest array of returns throughout all alternative possession courses - as you can see below. Methodology: Interior rate of return (IRR) spreads out calculated for funds within classic years separately and afterwards balanced out. Median IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The impact of including private equity into a portfolio is - as constantly - dependent on the portfolio itself. A Pantheon study from 2015 suggested that consisting of exclusive equity in a profile of pure public equity can unlock 3.

On the various other hand, the very best personal equity companies have accessibility to an even larger swimming pool of unidentified opportunities that do not deal with the very same analysis, along with the resources to do due persistance on them and identify which are worth investing in (Private Equity Firm in Texas). Investing at the very beginning implies higher risk, however, for the business that do be successful, the fund advantages from higher returns

The 5-Second Trick For Custom Private Equity Asset Managers

Both public and personal equity fund managers devote to investing a percent of the fund however there stays a well-trodden problem with straightening rate of interests for public equity fund monitoring: the 'principal-agent issue'. When a capitalist (the 'major') works with a public fund supervisor to take control of their resources (as an 'representative') they hand over control to the supervisor while preserving possession of the properties.

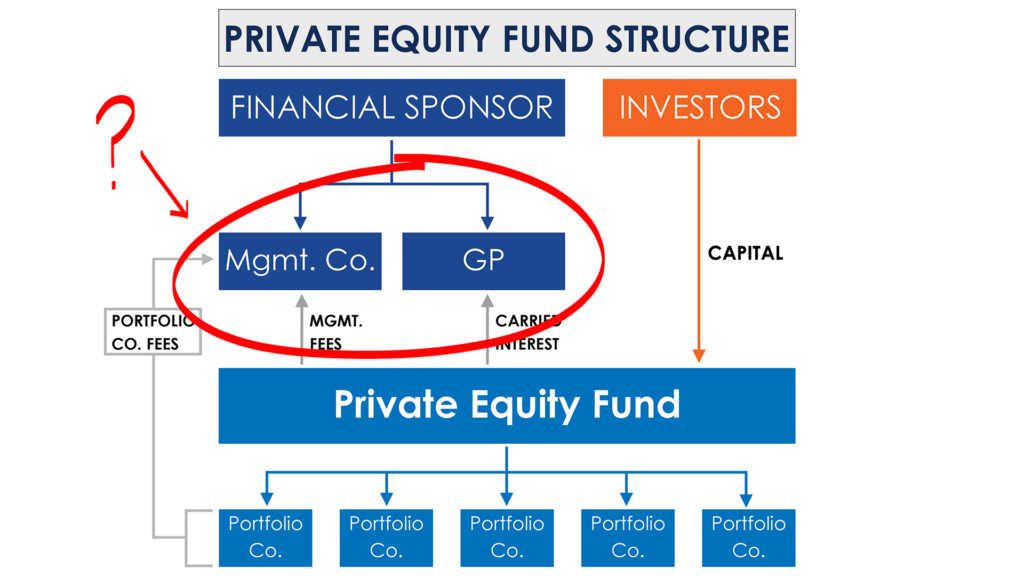

In the instance of personal equity, the General Companion doesn't just gain a management charge. Exclusive equity funds likewise alleviate one more type of principal-agent problem.

A public equity investor inevitably desires one thing - for the management to increase the stock price and/or pay rewards. The capitalist has little to no control over the choice. We showed over how several personal equity approaches - specifically majority acquistions - take control of the running of the firm, making sure that the long-term worth of the company comes initially, pushing up the roi over the life of the fund.

Report this wiki page